Would you leave the comfort of your home in Boston to move to tropical São Paulo? Even without knowing a word of Portuguese?

Parker Treacy was all in for the adventure. He moved to Brazil 5 years ago and founded Cobli, a startup in fleet management. Parker is from Harvard 2012 class.

Parker is the founder and CEO of Cobli, a startup dedicated to help companies reduce their costs through the use of cutting edge technology.

Keep reading to learn how Parker scaled his first company during his MBA, how was his transition to Brazil and why Brazil is such an amazing place to be an entrepreneur.

You can also listen on iTunes, Google Podcasts, and CastBox, or in any other podcasting app by searching for “MBA Talk”.

If you enjoyed this episode be sure to join our mailing list to find out about what books are coming up, giveaways we’re running, special events, and more.

Check out our courses specifically designed for MBAs

Learn how to manage a backlog, workload, hand off activities to a team, differences managing company employees vs contractors and much more!

Coming Soon –> Connect if you want to know more!

Design thinking is all about creating unique solutions to complex problems — no matter how big or small.

Coming Soon –> Connect if you want to know more!

- 2-days long

- Instructor-led

- Management focused

- Methodology to attain goals and solve problems

- Use of real case studies

- Green Belt certification included

Live a day working with the Sprint methodology created at Google Ventures to solve big problems and test new ideas in just 5 days.

Coming Soon –> Connect if you want to know more!

Episode Notes

The Adventure of Starting a Company in an Unknown Country

Where are you from and where are you now?

[0:58] I’m originally from Boston. And I’m calling today from Sao Paulo, where I’ve been living for the better part of five years. My company Cobli is based here. So I spend a lot of time here locally in Sao Paulo.

Why did you come to Brazil?

[1:24] I’d say that 50% of it was certainly just coming down due to the adventure. I’d already started a different company in the United States. This was right after finishing my MBA and saw it as my last opportunity to take a really big risk. I saw the risk of starting a company in a new country, a new language, and a new culture.

It hit a number of things I was trying to optimize that time in my life. And then also for what I do is I only do automotive and logistics-related startups.

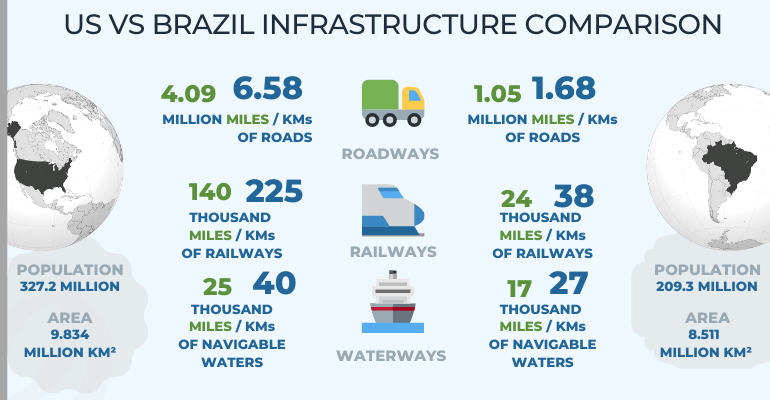

Brazil is a very big world for KC (Known Consignor), anything I knew logistics and automotive. Just a big country, massive huge landmass, lack of a rail system and other logistic infrastructural points that we rely on in the United States, Brazil lacks those rents. There’s a lot of really cool products that could be launched here, locally. And it’s a very limited competition. So I saw a really cool opportunity to start something.

Have you considered other countries?

[2:28] Yes. So we’re currently active in a few other countries, mostly down here in South America and also a few countries in Europe. But our vision is to become the biggest fleet management company in Latin America, it is our goal. From a distribution standpoint, we’re based in Brazil, the vast majority of our revenue is Brazil today. But our vision is we want to dominate from Mexico to Argentina.

Do you have any favorite resources related to entrepreneurship?

[2:59] A lot, I would say my favorite book, which is definitely a bias from the MBA is Clayton Christensen’s The Innovator’s Solution which is the sequel to The Innovator’s Dilemma. And I thought that book more than any other book changed the way I think about strategy and business creation.

Other than that, I would say that I follow a number of different VC blogs. I find them all pretty useful. I’d probably say the autobiography I like the most was Marc Benioff’s, just because it showed the incredible importance to be both an incredible salesman and showman when getting something off the ground. It certainly wasn’t as academically deep as a Christensen’s book, but there are just so many interesting tidbits of learning how we thought about solving problems, and how we thought about communicating value and stuff like that. So those are certainly two that come to the top of mind.

Have you always had that impulse of being an entrepreneur?

[4:28] I’d say that when I was undergraduate I probably didn’t have. I certainly had a little bit of an impulse but it certainly wasn’t something really profound.

As it was coming to the end of college I’d say that my dad was pushing me quite a bit to start a company. He’s someone who would always start his own businesses and he saw employment as a waste of time from a learning standpoint, and when you are in your 20s you’re just trying to accelerate learning as fast as you could. So he really pushed me to start a business. And that was probably the origin of how First Help Financial got started. It was that pushing.

And it really started as the research began in my senior year. I was committed to it basically, at the end of my junior, early senior year, where I tried to use all the university resources possible, people are really responsive when you email them with the university email address and stuff like that, with the plan to get started the second I graduate.

Scaling a Startup While Doing an MBA at Harvard

What is the first company you created about?

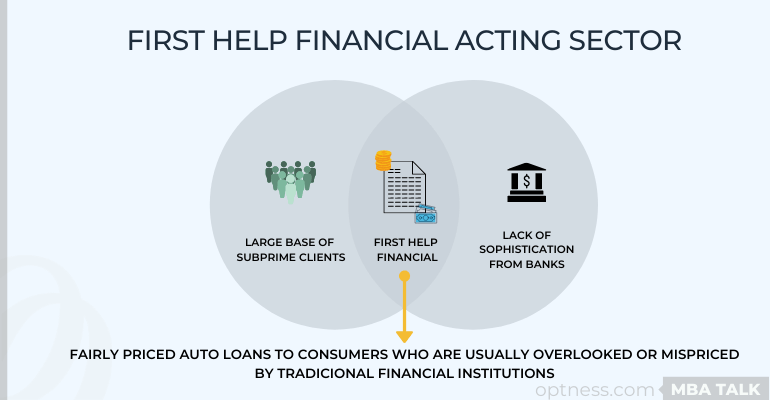

[5:28] It is First Help Financial, an auto finance company, and what our original vision was, we saw a very large base of clients in the subprime space and we saw this sophistication that banks and finance companies had for pricing these clients was very low.

Today we have a number of different types of clients that we target. From the very beginning, we wanted to create an amazing loan product for the recent immigrant, typically from Latin America. At the very beginning, it was all built around how do we create this amazing product, as a product distributed through car dealerships. So we had all the complexity of dealing with channel distribution as well.

But all the original seed came from let’s create a better product for recent immigrants for automotive.

Is First Help Financial still active?

[6:42] It is. Today we’re the largest independent auto finance company in New England, and we’re about the 10th largest in the United States. And I’d say Cobli is certainly a continuation of a lot of themes in my life that started at First Help Financial.

What made you feel the need to go for an MBA?

[6:57] The first few years of First Help Financial were not very successful years. At the very beginning, I had a few co-founders, we were trying to figure everything out, like literally when I graduated, I was a Mathematics major.

I knew nothing about accounting, for example. And we were literally learning what a balance sheet was, and learning how auto finance worked and learning how to become an auto lender from a regulatory standpoint, we’re trying to learn a million things all at the same time.

We launched in 2007 and then in 2008, the subprime crisis hit and we’re fundamentally a subprime auto finance company. Fundraising as you can imagine, was really hard when there’s a new bank falling every 48 hours. We tried to raise money in 2008 and 2009. We didn’t have any success, my two co-founders left. At that time I was left with me and one and a half employees to try to manage the loan portfolio that we currently had in our books.

What I did to try to hedge my bets was apply to an MBA at Harvard. Luckily, I got in. It was a few miles from our office. And the irony is right when I was about to start Harvard in 2010, we get a check for $10 million from Wells Fargo. So right as I started the MBA, we had a huge influx of cash.

From the start of the MBA, I probably went from five employees to 40. At that time, and since then, we’ve raised about 150 million dollars, and we have a team of about 150 employees and two offices. So we’ve scaled quite a bit since that MBA.

But the reason I really did it is I was trying to hedge my bets. I really had no idea what the future held. The company was in a very difficult situation as the world seemed like it was ending at the time.

And so that was the original reason that I did it, but I also wanted to, I know an incredible amount about the auto finance world and I knew very little about the rest of the world. We’re a very focused team on creating value for that end client through an auto finance product.

It’s also that I wanted to broaden my horizons, I wanted to meet a lot of new people. As the company became more and more profitable, I also realized that I wanted to take on a new adventure before life catches up with you, and your appetite for risk was zero. And so I very much used it as a platform through which I could insert myself into Brazil.

Was your dad against your MBA education?

[9:31] No, he wasn’t against the MBA. And I think the MBA at the time, it made sense and in a number of different ways. And I think both parents are pretty proud of the risks and successes I’ve had, but I mean, obviously most parents, our parents always want you to come back. Come back to where you’re from. So it’s both pride and conflict are kind of mixed emotions there.

How were you able to balance MBA life with the growth of your company?

[10:05] Yeah, it was tough. We had just gotten a lot of money. And so hired really capable people to do the core process, and it was really during the MBA.

I became more of a board member and a strategic advisor. I still did a lot of operational. And then for the next few years after the MBA, I was still very involved operational. But yeah, my challenge instead of me being a core operative, my challenge really became a people operation’s challenge. How do we put the really high capacity people into the right roles in order to scale the business?

Harnessing the Brand of the Business School

What were the resources from school that you took advantage of?

[10:43] I’d say the biggest source I took advantage of was mainly I knew pretty early on that I wanted to go down to Brazil. First Help Financial we deal with a total of 10,000 Brazilian clients in our portfolio and about 50 Brazilian employees. And so, I’d always had a strange connection to the country even though I’d only visited a few times.

I’d say the biggest thing is that people respond to your email when you email them from a student email address. And so I emailed every single person, especially in the automotive industry, during that time, and lots of people responded to me, and I did a lot of really cool things.

So I used the network and the brand that a place like Harvard Business School gives to you to really pave the path. And I don’t want to undermine the learning because I did think it was one of the coolest educational environments I’ve ever been in, and certainly, now people to it’s like, man, two-thirds of my best friends certainly are MBA friends. I’d say those are the biggest things that I use. Use the network and the brand to pave my way to figure out how to get to Brazil.

Who were the people that influenced you the most?

[12:14] I think the most impactful professor, it sounds a little generic, but it was Clayton Christensen. It was the best Professor I ever had, at age best. He was the only class that truly changed how I thought about strategy. And it was a class where you basically read through his book right, so I think that was probably, definitely the most academically impactful.

Then I had some really awesome professors like Aldo Musacchio, who’s kind of a Latin American guy who was really helpful of just contacts and how to think about it. You basically try to, through network, fill in a lot of the gaps and knowledge like it, some people really understood how to capitalize business or really understood how to distribute products, really understood how to build technology, and different friends who kind of fill those gaps and knowledge that they had at the time.

Looking back, would you have chosen to do the MBA again?

[13:10] Yeah. I mean, assuming my context was the same, absolutely. It was one of the most memorable experiences of my life. And it really did help me a lot when I got down to Brazil. It was a perfect tool that I was looking for. I got more value out of it than I think, almost anyone I know.

Starting a Fleet Management Company in Brazil

How did you transition to Brazil after the MBA?

[13:40] So I actually didn’t get down to Brazil until 2014. Almost two years after graduating, just because there’s a lot of administration and just legally opening up a business. I got down in 2014, really knew very few people just kind of a small network from the MBA, and so it was about how do I meet people? How do I, basically how do I accelerate the learning curve? So I understand what I want to do as quickly as possible.

Pretty quickly, I kind of saw the vision. I think vehicle connectivity is something that will be ubiquitous within the next decade. Whereas Latin America’s 90% of the cars have no connectivity. I’m speaking more specifically about commercial vehicles. So vehicle fleets and stuff like that. And I basically looked at those guys, I think there’s the combination of amazing technical town in Brazil, and then a massive untapped market. And so let’s create the most scalable product they can take advantage of a market that someone will take advantage of, let’s be that someone.

What’s the main product you have at Cobli?

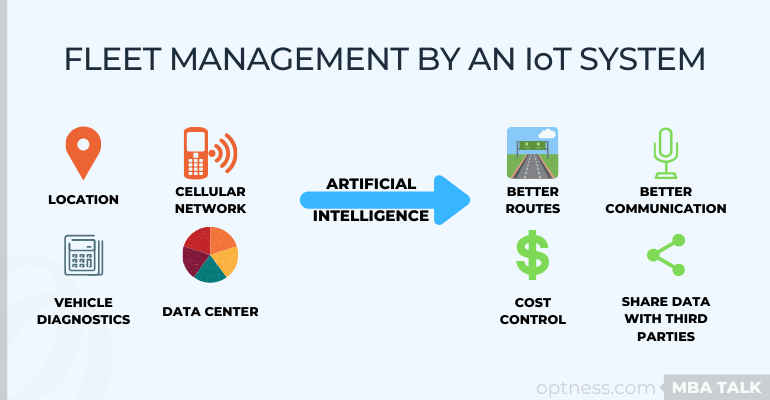

[14:46] So we do is what’s called fleet management. So it’s an IoT system and internet system where you put a basic sensor into the vehicle. That sensor collects a bunch of different data like location, movement, vehicle diagnostics, the data center, the cellular network, we then collect the data in our databases and do a bunch of different analytics to create, to turn that data into intelligence for a manager.

So intelligence can be things like routing and dispatch. So how do I plan my routes better and communicate that to drivers? And you have something to do with cost control and compliance. How do I manage my drivers better to make sure they’re there within compliance? How to measure the total cost of ownership of the vehicle? And then finally, we’re a data grid that enables fleets to share their data with third parties. So it will be how do I share the estimated time of arrival with my customers? Instead of a million different phone calls, you can just see exactly when the car will arrive in real-time.

And then all the way to how your vehicles drive is what will release an API (Application programming interface) for you to send that to different commercial insurance companies. You can get bids of insurance in real-time, that having to go through the old school network of a broker and tons of phone calls, etc. As we have all the data that we have all your driving data, you know exactly your list in real-time. How about you just send that data to insurance companies to facilitate what is a high friction transaction?

So the third part is really how do you create an API to send your data to the other party so the consumption of goods and services becomes much more simple. Things like fuel cards, vehicle acquisition, and destined distribution as well.

Where did the idea of a company come from?

[16:31] The core idea of vehicle connectivity and fleet management is not new to the world idea. We just saw that there are no sophisticated players doing this in Latin America. Let’s create a specific solution then become really good at distribution. So on that level, we’re not reinventing the wheel.

The way that we see our vision is a little bit different than the vision of other fleet management companies that we very much view of what we’re creating is we’re, fundamentally, digitizing an offline world of vehicles or an offline world, or trying to turn them into an online world. By doing that is that once everything’s digital, is that if you can share that data with other parties to facilitate communication or facilitate the transaction of insurance or other services, everybody’s better off.

And so, the long term vision outside of just being an off, best fleet management to a Latin America is that we very much see us as being a data grid, through it a number of different companies will want to use this data to power either their core services or the distribution of their services or products, and fundamentally help communication between all the different players in the supply chain.

Are you profitable today?

[17:40] No, we’re not profitable today. It has not been a focus of ours. We both raised a bunch of money, we intend to raise more money in the future and rent outgrowth is much more important than a focus on profitability. But obviously, we don’t lose focus on unit economics and the financials ever. As I said, our focus is growth and scale is more than it is profitability right now.

What were your expectations in your first year in Brazil?

[18:16] In the first year in Brazil, I had no employees and no company and I was just still trying to figure out how to do basics like how do I rent an apartment, and just get a cell phone and do all this basic stuff.

There’s certainly a lot of cultural friction because my communication was much more limited than it is today. I knew nobody and just dealing with all of that. So the first year was really fun. But it was obvious that everything you did was really high friction because you didn’t understand how the system works. My Portuguese is pretty limited.

And so very much is about discovering, figuring everything up, but I enjoy those types of challenges. It wasn’t something I look back on with disdain or anything like that.

What do you expect for this or next year?

[19:16] We as a company launched two years ago. So we have two years of operation, our team is about to hit the 100% headcount mark. And I can’t give you revenue numbers, but we’re on the multiple millions of dollars of revenue. We’re really excited about the growth that we’ve currently had. We’d like to in the next two years to anticipate our headcount getting to about 400 people, and our revenue multiplying by about 10x. So we’re very excited about the opportunity that lies ahead of us.

Untapping opportunities in Brazil

Do you see other opportunities here in Brazil that other MBAs can take advantage of?

[19:59] So first, I think Brazil is an amazing place to open a company, from a number of different standpoints. Specifically, it’s really inexpensive to launch a company. Hiring a really high-quality team is a fraction of the cost of what it is in the United States. That itself is a big opportunity. I mean, we’re in the sixth biggest economy in the world, and everything is like being in the United States like 15 to 20 years ago.

And so, as long as you choose an industry that doesn’t already have really sophisticated competitors, I don’t start a ride-hailing company, for example. I think the opportunities are really big all around. The caveats I would say, though, is when coming to Brazil, you want to have an idea that is, for lack of a better term, less revolutionary. Because Brazil lacks basic stuff. It’s so far behind from what is the United States and so I think launching fundamentally very basic models that are powered by technology, so you can scale at a good pace and raise enough money to do so. But it’s obvious it’s solving much more basic problems.

Especially if you have access to capital, and you’re a good operator, and you have a decently long time frame, your time horizon in Brazil is 10 years. Because competition will not kill you, what might kill you is running out of money for operating badly, etc. And so as long as you can hedge those risks away, I think it’s a really amazing place to start a business.

Did you have other ideas?

[21:28] Yeah, I mean, I have a lot of different ideas for Brazil. But, for me personally, we’re very focused on what we’re doing. And I think one of the biggest challenges is when there’s so much cool stuff around, staying focused is one of your biggest challenges and your ability to deploy capital in a highly focused and highly measured way is the difference between being highly successful and being a failure. And so there’s a lot of things that get me very excited about Brazil, but the focus is everything.

Is there any topic you see that’s trending here in Brazil?

[22:26] I mean, an industry that we deal with peripherally is insurance. I think the insurance space from top to bottom has incredible opportunities. Incredible. I think the way insurance is distributed, and literally, I’m generalizing every type of insurance. The way insurance is distributed is incredibly antiquated. It’s priced is incredibly antiquated. How it’s operated from a claim standpoint is incredibly antiquated. Even the way insurances managed from a balance sheet standpoint is incredibly antiquated.

The downside is there are big barriers to entry because you’re dealing with a highly regulated world, and usually, one that’s reasonably capital intensive, but not incredibly capital intensive. Then the other downside to insurance is that it saves a very idiosyncratic world. Typically having some sort of insurance background helps a lot, because there are weird cultures built into the system. There are weird alliances that don’t make sense from the outside. There’s a lot of things that are very confusing about it.

But as long as someone has the patience to take all those apart, focus very carefully and what your MVP is going to be, and then have the ability to have the showmanship, and the ability to sell a dream to raise capital to do so. I see it’s another part of that market here. That’s it’d be very hard to miss if you have a decently long term time horizon.

Any advice for aspiring MBA entrepreneurs?

[24:01] Nothing super-specific. I’m obviously very pro Brazil, and pro-Latin American in general. I think the next 20 years of emerging markets is going to be really fast in the next 20 years.

I don’t know, I’d probably say I think MBAs are probably excessively risk-averse. And I’d probably say, push them to be less risk-averse. It would probably be my only feedback. I think that now that I’m what, six, almost seven years removed from the MBA, I think the biggest regrets people have around me is, typically, that they didn’t take enough risks. There are some incredibly powerful minds that have done amazing things, but I’d still think they have sub-optimized the value that they have sitting on their shoulders.

So I’d say that’d be my biggest criticism of MBAs, and my biggest feedback on what not to do when leaving that.

—

Thank you for joining this episode of the MBA talk podcast, a podcast brought to you by Optness Institute. You can find all notes for this episode, as well as subscribe for future episodes at www.optness.com/mbatalk. And if you’re enjoying the show, or have any comments, topics, or guest suggestions, I’d love you to shoot me an email. My name is Andres and you can write to me at mbatalk@optness.com. With that, thank you and we’ll see you in the next episode.

Source of images:

Addicted04 [CC BY-SA (https://creativecommons.org/licenses/by-sa/3.0)]

Addicted04 [CC BY-SA (https://creativecommons.org/licenses/by-sa/3.0)]

Check out our courses specifically designed for MBAs

Learn how to manage a backlog, workload, hand off activities to a team, differences managing company employees vs contractors and much more!

Coming Soon –> Connect if you want to know more!

Design thinking is all about creating unique solutions to complex problems — no matter how big or small.

Coming Soon –> Connect if you want to know more!

- 2-days long

- Instructor-led

- Management focused

- Methodology to attain goals and solve problems

- Use of real case studies

- Green Belt certification included

Live a day working with the Sprint methodology created at Google Ventures to solve big problems and test new ideas in just 5 days.

Coming Soon –> Connect if you want to know more!